When you get a relatively cozy credit union crowd together for two days in the heart of the credit union universe, some interesting things happen.

On day two of Disruption ’17 by CU Water Cooler, in Madison, Wis. there was a sense of impending good coming to the credit union industry. With the positivity came levity from some speakers during one of the more radical CU conferences of the year.

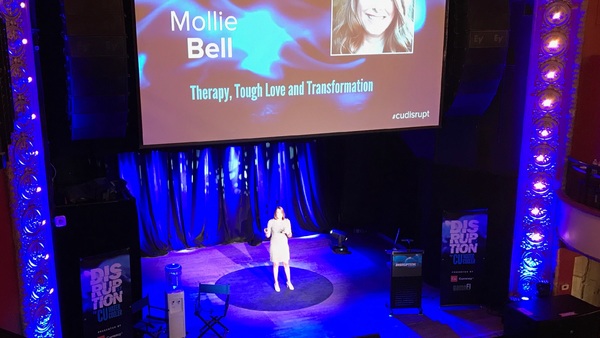

Levity came in the form of Mollie Bell, the Chief Engagement and Transformation Officer at CUNA, headquartered in Wisconsin’s state capital.

“Sometimes we’re not sure if credit unions can keep up,” she said with a tone of hopefulness. Bell was discussing the rapid changes happening in the credit union landscape – from regulations to fintech to focusing on a proper strategy.

Bell believes that, unlike a handful of years ago, that credit unions are in a much better place. “The problem now for credit unions is that we’re doing well right now – and we’re also breeding complacency,” she said.

Bell advised that these good times are the right time to take some bold steps to drive even bigger and better change for members.

She suggested five strategic ways to push for that change:

- Find Your “Who” – “In order for you to create a ‘How do we do this?’ you have to know who you’re doing it for.” Bell pointed out the strength of credit unions knowing and really understanding who they serve. “Because you can’t be everything to everyone,” she said.

- Setting Stretch Goals – Bell asked the audience to find a way to push their “staff, or team or board to drive that change.” And she recognized that during times of success is one of the more difficult times to get people to move and stretch themselves. “But when you’re at the top of your game is exactly the right time to see what more you can do,” Bell said.

- Strategy and Culture Combined – Bell suggested that credit unions drive a culture that’s a strategic culture. “You have to be able to teach your staff to make strategic choices when dealing with members,” she said. This, Bell mentioned, will empower the staff to get behind the credit union’s strategy.

- Experiment and Explore – “Push innovation!” Bell exclaimed. She mentioned the importance of finding a way for credit union leaders to push their teams to explore what they do. “If we don’t invest in the idea of the notion of ‘explore,’ you’ll fall behind,” Bell said.

- Execute Your Strategy – this idea boils down to having the right people doing the right jobs. “Not everyone can or should be a project manager,” Bell said. She noted that credit unions must find the right expertise to properly execute a strategy.

“We have to create a choice (for members) to make things better for credit unions,” she said.

In all, nearly 200 credit union leaders, financial cooperative and fintech professionals attended this year’s Disruption ’17.