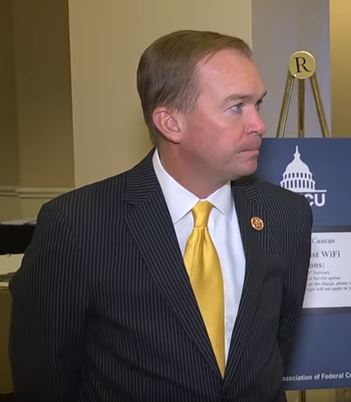

As a Republican House member from South Carolina, Mulvaney supported legislation to abolish or restrain the CFPB and the credit union trade groups clearly view him as an ally.

President Trump selected Mulvaney to run the agency on an interim basis. However, before he left office former Director Richard Cordray designated his deputy, Leandra English, as acting director. She has sued Trump over the issue.

Given the pending legal battle, any action that the CFPB takes likely will face a legal challenge.

In a letter to Mulvaney, CUNA President/CEO Jim Nussle—himself a former OMB director–said that the CFPB has issued broad rules that are intended to rein in “irresponsible practices of other industry stakeholders.

He added that the agency repeatedly has failed to consider the size, complexity, structure or mission of credit unions.

Nussle said that the agency should not finalize any rule affecting credit unions unless they are intended to provide relief for credit unions. He asked Mulvaney to ensure that no new rules are proposed that will affect credit unions.

And he asked Mulvaney to allow the NCUA to administer examination and supervision of all credit unions—even ones that have more than $10 billion in assets.

Democrats already have expressed fear that Mulvaney will dismantle much of the agency’s work and that English is the rightful agency director.

“Independence is critical to the Consumer Financial Protection Bureau’s ability to aggressively and successfully fight for hardworking Americans and against Wall Street abuses,” said Senate Banking Committee ranking Democrat Sherrod Brown of Ohio.

Republicans say that Mulvaney is the acting director and they viewed the appointment as an opportunity to rein in the agency.

“With the resignation of Richard Cordray, there is now a wonderful opportunity to completely reform what has been a rogue agency that often harmed the very consumers it was charged with helping,” said House Financial Services Chairman Jeb Hensarling (R-Texas).

But is continues to be unclear who is in charge at the agency.

English and Mulvaney even sent out competing messages to agency staff. In his message, Mulvaney directed CFPB staff members to ignore any directions issued by English.

Sen. Tom Cotton (R-Ark) said any agency employee who implements a direction from English should be fired.

One credit union lobbyist said the dueling appointments represent more than a clash of policies.

“The ‘House of Cards’ melodrama that’s unfolding at CFPB is interesting and fun to watch at some level, but underneath are serious questions about competing philosophies of government, said John McKechnie, senior partner at Total Spectrum. “The Cordray regime at CFPB was one of the last bastions of the Obama Administration, and certainly one of the most high-profile and controversial.”